Do You Need a Financial Advisor? Decoding the Money Maze Pengantar Dalam kesempatan yang istimewa ini, kami dengan gembira akan mengulas topik menar

Do You Need a Financial Advisor? Decoding the Money Maze

Pengantar

Dalam kesempatan yang istimewa ini, kami dengan gembira akan mengulas topik menarik yang terkait dengan Do You Need a Financial Advisor? Decoding the Money Maze. Ayo kita merajut informasi yang menarik dan memberikan pandangan baru kepada pembaca.

Table of Content

Video tentang Do You Need a Financial Advisor? Decoding the Money Maze

Do You Need a Financial Advisor? Decoding the Money Maze

Let’s face it: Money. It’s the engine that powers our lives, fuels our dreams, and sometimes, keeps us up at night. Whether you’re a fresh graduate navigating your first paycheck or a seasoned professional planning for retirement, the world of finance can feel like a confusing maze. That’s where the question arises: Do you need a financial advisor?

Why Is Finance So Confusing?

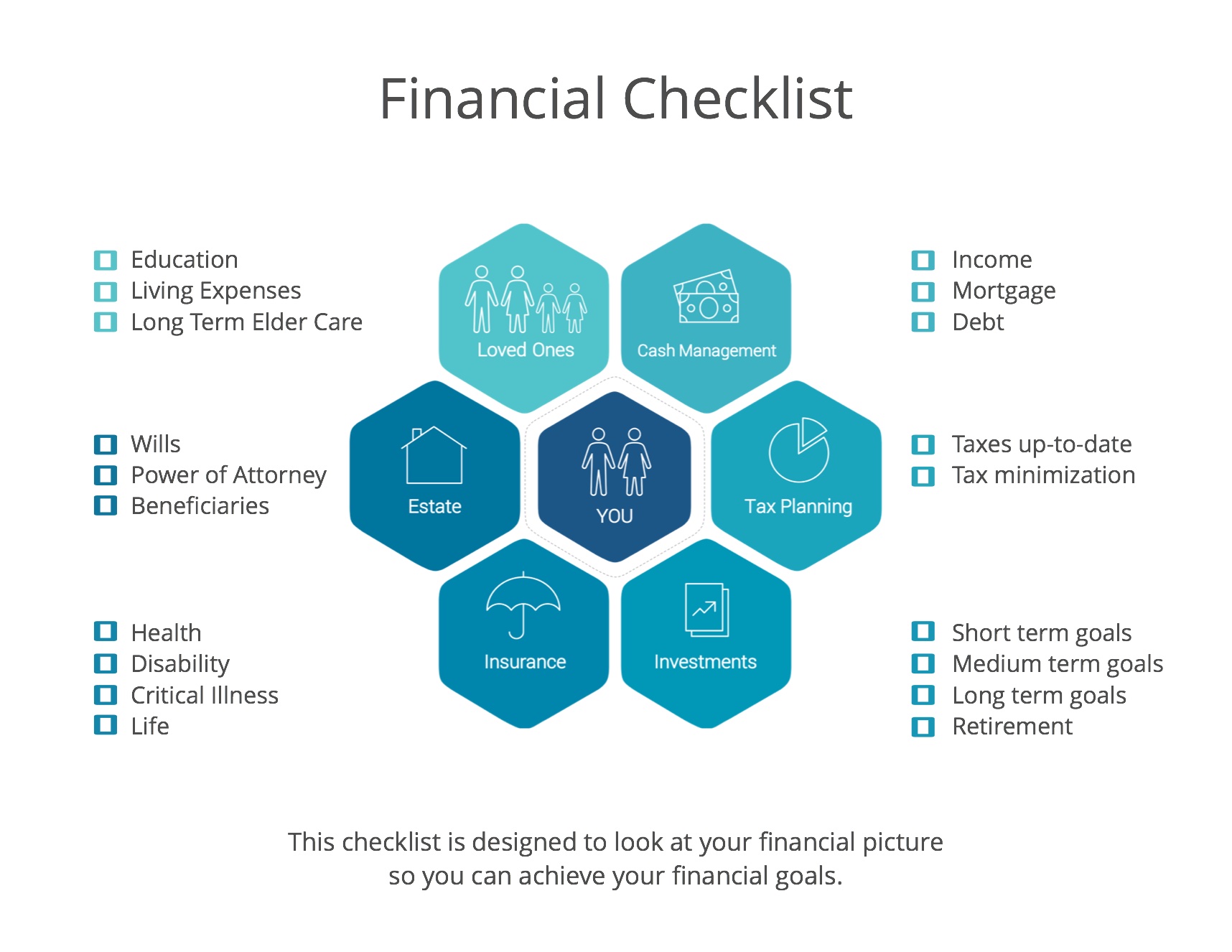

Before we dive into whether you need an advisor, let’s acknowledge the complexity of personal finance. It’s not just about saving and spending. It involves:

- Investments: Stocks, bonds, mutual funds, real estate… the options are endless, each with its own risk and reward profile.

- Taxes: Understanding how taxes impact your income, investments, and retirement accounts is crucial.

- Retirement Planning: Estimating how much you’ll need to retire comfortably and creating a strategy to get there.

- Insurance: Protecting yourself and your assets from unforeseen events with the right insurance coverage.

- Estate Planning: Ensuring your assets are distributed according to your wishes after you’re gone.

All of these elements are interconnected and constantly changing, influenced by economic trends, market fluctuations, and government policies. It’s no wonder many people feel overwhelmed!

Signs You Might Need a Financial Advisor

Okay, so when is it time to call in the professionals? Here are some telltale signs:

You’re Overwhelmed: Do you feel stressed or anxious when you think about your finances? Do you avoid looking at your bank statements or investment accounts? If so, a financial advisor can provide clarity and peace of mind.

-

You Don’t Know Where to Start: You know you should be saving more, investing smarter, or planning for retirement, but you have no idea how to begin. An advisor can help you create a personalized financial plan tailored to your goals.

-

You’ve Experienced a Major Life Change: Getting married, having a baby, buying a house, changing jobs, or receiving an inheritance can all have a significant impact on your finances. An advisor can help you navigate these transitions and adjust your financial plan accordingly.

-

You Lack the Time or Interest: Let’s be honest, not everyone enjoys managing their finances. If you’d rather spend your time doing other things, a financial advisor can take the burden off your shoulders.

-

You’re Nearing Retirement: Retirement planning is complex, involving estimating your expenses, determining your income sources, and managing your investments to ensure they last throughout your retirement years. An advisor can help you create a comprehensive retirement plan.

-

You Need Objective Advice: It’s easy to get caught up in emotional decision-making when it comes to money. An advisor can provide unbiased, objective advice to help you make rational financial choices.

-

You Want to Optimize Your Finances: Even if you’re already doing a decent job managing your money, an advisor can help you identify areas where you can improve, such as reducing taxes, maximizing investment returns, or optimizing your insurance coverage.

What Does a Financial Advisor Do?

A financial advisor is a professional who provides guidance on managing your money. They can help you with a wide range of financial matters, including:

- Creating a Financial Plan: Developing a comprehensive plan that outlines your financial goals and strategies for achieving them.

- Investment Management: Helping you choose investments that align with your risk tolerance and financial goals, and managing your portfolio on an ongoing basis.

- Retirement Planning: Estimating your retirement needs, creating a savings plan, and managing your retirement accounts.

- Tax Planning: Identifying tax-saving strategies and ensuring you’re compliant with tax laws.

- Insurance Planning: Helping you choose the right insurance coverage to protect yourself and your assets.

- Estate Planning: Working with you to create a will, trust, and other estate planning documents.

Choosing the Right Financial Advisor

If you’ve decided that you need a financial advisor, it’s important to choose one who is qualified, experienced, and trustworthy. Here are some tips:

- Check Their Credentials: Look for advisors who have certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Chartered Financial Consultant (ChFC). These designations indicate that the advisor has met certain educational and ethical standards.

- Understand Their Compensation Structure: Advisors can be compensated in different ways, such as through fees, commissions, or a combination of both. Make sure you understand how the advisor is paid and whether there are any potential conflicts of interest.

- Ask About Their Experience: Find out how long the advisor has been in the business and what types of clients they typically work with.

- Read Reviews and Testimonials: See what other clients have to say about the advisor’s services.

- Meet With Several Advisors: It’s a good idea to meet with several advisors before making a decision. This will give you a chance to compare their qualifications, experience, and fees, and to see who you feel most comfortable working with.

The Cost of Financial Advice

Financial advice isn’t free, but it can be a worthwhile investment if it helps you achieve your financial goals. The cost of financial advice can vary depending on the advisor’s compensation structure and the services they provide. Some advisors charge an hourly fee, while others charge a percentage of the assets they manage.

The DIY Alternative

Of course, not everyone needs a financial advisor. If you’re comfortable managing your own finances, there are plenty of resources available to help you, such as online tools, books, and courses. However, if you’re feeling overwhelmed or unsure of where to start, a financial advisor can be a valuable asset.

The Bottom Line

Deciding whether or not to hire a financial advisor is a personal decision. There’s no one-size-fits-all answer. However, if you’re feeling overwhelmed by your finances, lacking the time or expertise to manage your money effectively, or nearing a major life change, a financial advisor can provide valuable guidance and support. Take the time to assess your needs, research your options, and choose an advisor who is right for you. Your financial future will thank you for it!

Penutup

Dengan demikian, kami berharap artikel ini telah memberikan wawasan yang berharga tentang Do You Need a Financial Advisor? Decoding the Money Maze. Kami berharap Anda menemukan artikel ini informatif dan bermanfaat. Sampai jumpa di artikel kami selanjutnya!

COMMENTS